Summary

- Central banks all over the world have adopted easing monetary policies. Except for a very few exceptions, it seems like one size fits all.

- The Fed policy isn’t only surprising, but it’s actually unprecedented. So much so that some wonder whether rate hikes might be more appropriate than rate cuts.

- The Fed is not only known to be behind the curve, but it’s being led by the market for years. The last FOMC meeting was quite unique in that sense.

- In most times, you certainly don’t want to fight the Fed. However, if we’re heading into a major correction, let alone bear market, all bets/adages are off.

Easing All Over The Place

Last week, the Fed cut rates again, just as the market was “telling” it to do.

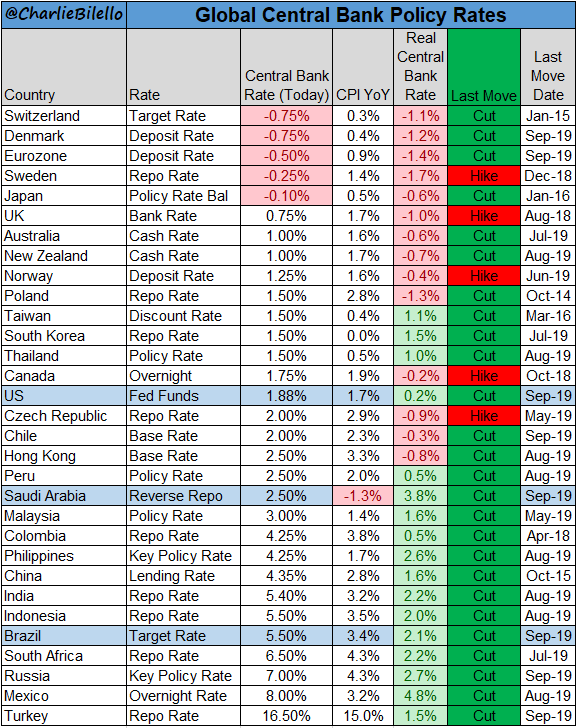

Doing so, the Fed continues to be part of a growing group of central banks that are cutting rates. Most recently, we saw rate cuts from the following countries:

- Indonesia (EIDO): Cutting 25 bps to 5.25%, for the 3rd straight month.

- Hong Kong (EWH): Cutting 25 bps to 2.25%.

- China (MCHI, FXI): Cutting rates for 2nd straight month, 5 bps move to 4.20%.

- Brazil (EWZ): Cutting 50 bps to an all-time low of 5.50%.

- Saudi Arabia (KSA): Cutting by 25 bps to 2.50%.

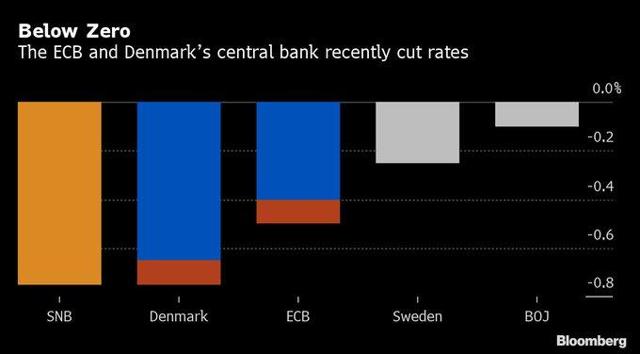

The outlier is Norway (NORW, ENOR) that chose to hike rates by 25 bps to 1.50%. Unlike its neighbouring country, Sweden (EWD) that hiked back in December but still keeps the benchmark rate at negative territory, this was the 4th time that the “Land of the Midnight Sun” has cut rates over the past year! Furthermore, unlike most of its European allies, the benchmark rate in Norway is positive; at 1.5%, some may actually choose to describe it as “extremely high”…

As you can at the above chart, only 5 countries chose their last move (when it comes to rates) to be a hike, out of which only Norway and the Czech Republic (NQCZ) did so this year. All other three countries – Sweden, the UK (EWU), and Canada (EWC) – hiked last year, so the “hiking” status is questionable right now, at the very minimum.

Against these 5 (or 2…), we have a long list of countries where central banks are cutting rates aggressively (in the order of their appearance in the above chart): Switzerland (EWL), Denmark (EDEN), ECB/Eurozone (VGK, EZU, HEDJ, FEZ, IEUR, BBEU, IEV), Japan (EWJ, DXJ), Australia (EWA), New Zealand (ENZL), Poland (EPOL), (Taiwan (EWT), South Korea (EWY), Thailand (THD), US (SPY, DIA, QQQ, IWM), Chile (ECH), Peru (EPU), Saudi Arabia, Malaysia (EWM), Colombia (GXG, ICOL), Philippines (EPHE), India (PIN, INDA), Brazil, South Africa (EZA), Russia (RSX, ERUS), Mexico (EWW), Turkey (TUR).

This is only a partial list, and there are many more countries cutting rates these days, surely way more than those hiking. Easing monetary policies is the name of the (central banks) game, and let’s not also forget that negative rates/yields are also becoming a very long chapter in the monetary policy playbook.

US Monetary Policy is Raising Eyebrows

When it comes to the US, the recent rate cuts are unprecedented in the sense that they are coming at a time when much of the economic data doesn’t support a cut. If anything, the following-current set of data is likely pointing at the need for a hike.

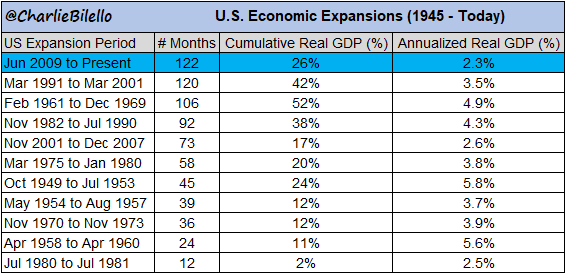

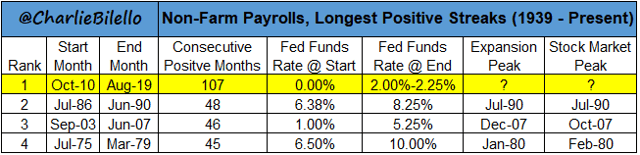

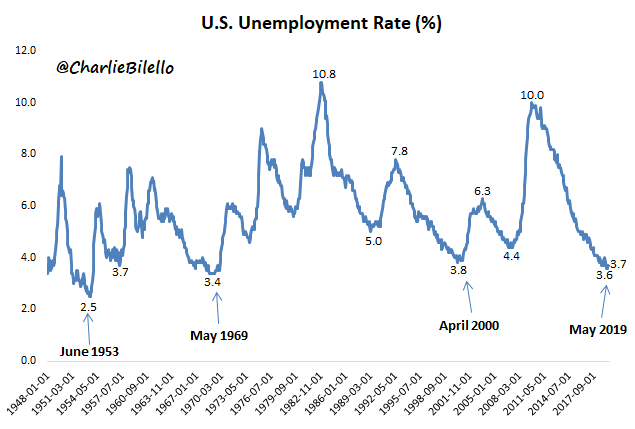

They will do so with the US economic expansion at 122 months (longest in history), 107 consecutive months of jobs growth (longest in history), and a 3.7% unemployment rate (0.1% above the lowest level since 1969).

1) The longest streak of economic expansion since the end of WWII. 122 consecutive months of positive growth, and counting.

2) The longest (by far) streak of job growth since the beginning of WWII. 107 consecutive months of positive non-farm payroll numbers, and counting.

3) Near the lowest unemployment rate since 1969. The current 3.7% unemployment rate is only a whisker above the current cycle’s low of 3.6% from May.

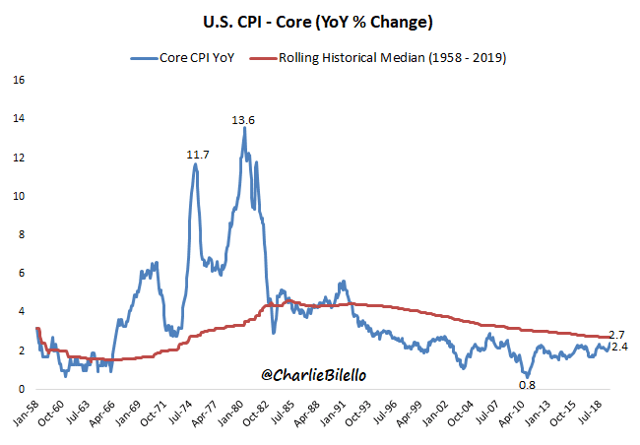

4) At 2.4%, core inflation – the preferred gauge by the Fed to measure pricing pressures – is at 11-year high, and closing fast on the rolling historical median.

Yet, in spite of these strong data/long streaks, the Fed has decided, for 2nd straight meeting, to cut rates by 25 bps.

Unprecedented, Unexplained, Moves

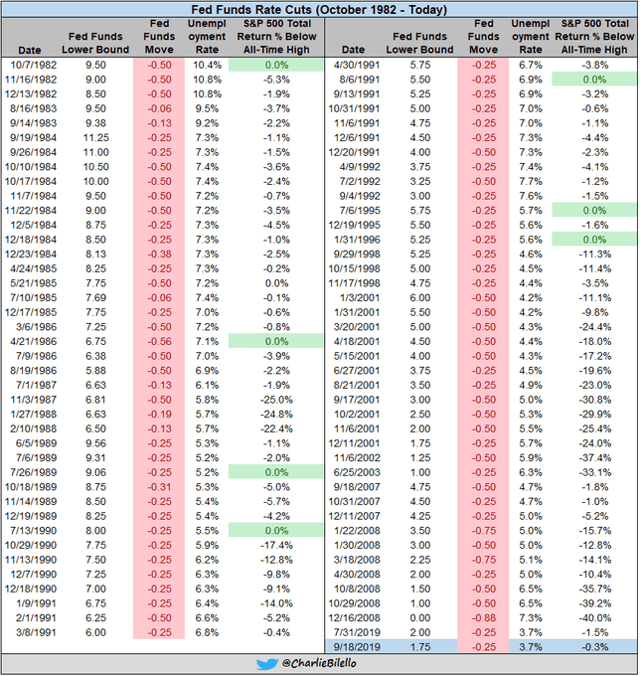

Here’s another angle to look at how rare is a Fed rate cut while the unemployment rate is at 3.7%.

Since 1982, when the Fed started to target the Fed Funds Rate specifically, it had never cut rates when the unemployment rate was lower than 4%. Never! The lowest unemployment rate that was accompanied by a rate cut took place in January 2001, when the unemployment rate stood at 4.2%.

The Fed’s recent rate cuts, coming at a time when economic data is anything but weak (at least as of yet), are not only causing many eyebrows to rise but actually being questioned by more than a few well-known and respected figures.

Take, for example, Scott Minerd, the chief investment officer of Guggenheim Partners. He believes that the Fed should consider raising rates rather cutting them, in order to prevent the economy (consequently inflation) from overheating.

“By almost every measure policy makers should be considering another rate hike in anticipation of potential economic overheating from looming limitations on output… Instead, debate has been focused on the need to take preemptive action to avoid a potential slowdown.

Taking into consideration that…

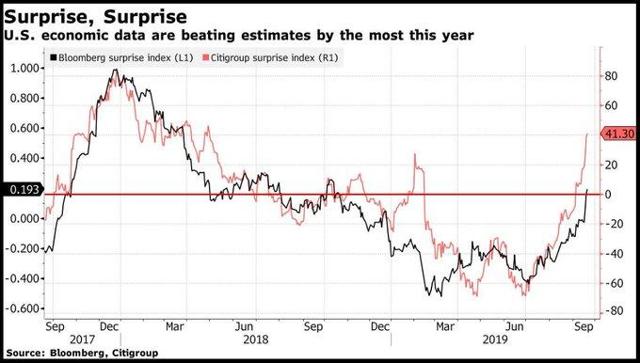

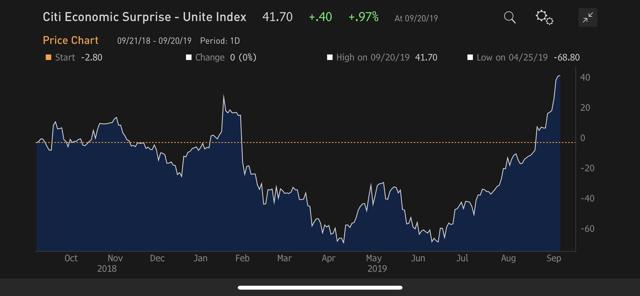

1) US economic data are beating estimates by the most this year; and

2) Citi US Economic Surprise Index has not only seen a very impressive surge but actually moved from deeply negative to significantly positive territory.

… he might have a point!

The Fed is Behind the Curve/Market

There were 83 FOMC meetings since the current cycle of economic expansion began (post subprime-crisis era), out of which:

- 72 meetings saw the market pricing (ahead of the meeting) no change to the Fed Funds, and no change is indeed what the market got.

- 9 meetings saw the market pricing a 25 bps hike to the Fed Funds, and a 25 bps hike is indeed what the market got.

- 2 meetings (July and September 2019) saw the market pricing a 25 bps cut to the Fed Funds, and a 25 bps cut is indeed what the market got.

If there is something you can bet on is that the Fed won’t deliver a surprise. Having said that, if the market is so accurate in predicting the Fed moves, before they take place, one might wonder what do we need the Fed in the first place? Let the market decide where rates should be with no need for the Fed to “confirm” the market’s monetary policy, retrospectively.

A central bank is considered to be “behind the curve” when it is not raising (cutting) interest rates at an appropriate pace to keep up, fast enough, with rising (falling) inflation.

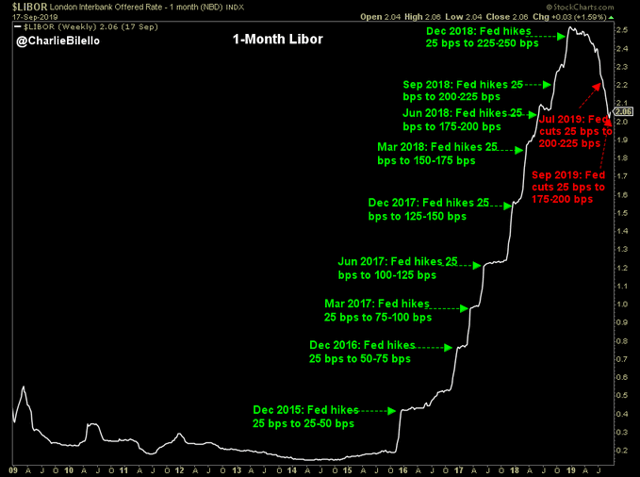

The Fed is being accused of being “behind the curve” for few years – and rightly so. They started to hike rates way too late, consequently reaching the peak of the cycle with rates that are way lower than where they should/could have been, as well as below where the Fed wanted/foretasted them to be.

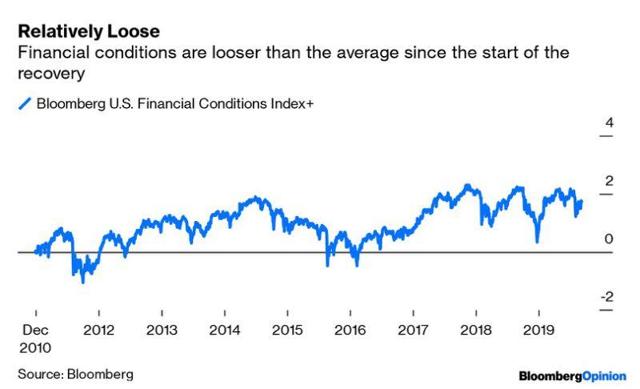

As a result, the Fed now has very little room to ease its monetary policy, especially if the economy is slowing down more than the current data implies.

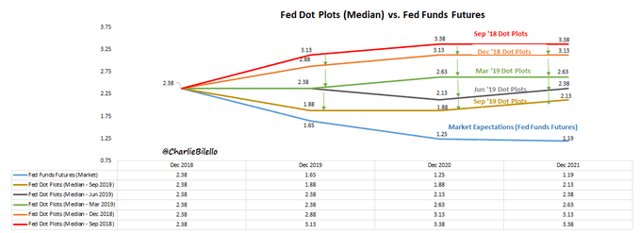

It was a year ago when the Fed was projecting a Funds Rate of 3.125% at the end of 2019. Based on the “dot plot” presented at the last FOMC meeting, Fed members have now moved that projection lower for the 4th time, seeing Fed Funds at only 1.875% by year-end.

Only one year (gone by), yet the projection of the Fed itself is down by 1.25%.

Thing is, 1.875% is exactly where we are now (the midpoint of the current 1.75%-2.00% range). Nonetheless, the market is still expecting one more cut by year end and another (at least one more) cut in 2020.

So, on one hand, we have the Fed’s median forecast showing that no more rate cuts are projected. On the other hand, we have the market still expecting more rate cuts. Based on the historical data (regarding past FOMC meetings) we presented above, we wouldn’t suggest betting the farm on the Fed’s own projection.

Having said that, the last FOMC meeting was probably Jay Powell best performance, thus far, as Fed chairman.

In spite of the President remaining unhappy (“Jay Powell and the Federal Reserve Fail Again. No “guts,” no sense, no vision! A terrible communicator!”. Source: Twitter), Powell – who sounded hawkish ahead of the meeting – managed to cause the market to reconsider its stance towards future rate cuts.

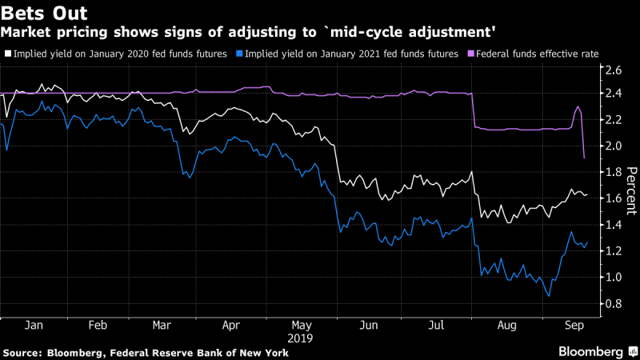

While the market is still pricing in a 62.8% probability for at least one more rate cut before year-end, the implied yields (based on Fed Funds futures) moved up recently, suggesting that more investors (than usual) think that perhaps the Fed will lead the market this time round.

Rate Cuts Aren’t Automatically Welcomed

Lloyd Blankfein, the former CEO and Chairman of Goldman Sachs tweeted last week (Et tu, Brute?) the following:

There’s an old adage, “don’t fight the Fed.” Means that if the Fed is on a tightening course, don’t be long. And if the Fed is lowering rates, as now, don’t be short. Doesn’t always hold true, but often enough to ignore. The Fed has a lot of tools to achieve its objectives.

— Lloyd Blankfein (@lloydblankfein) September 18, 2019

Let’s see…

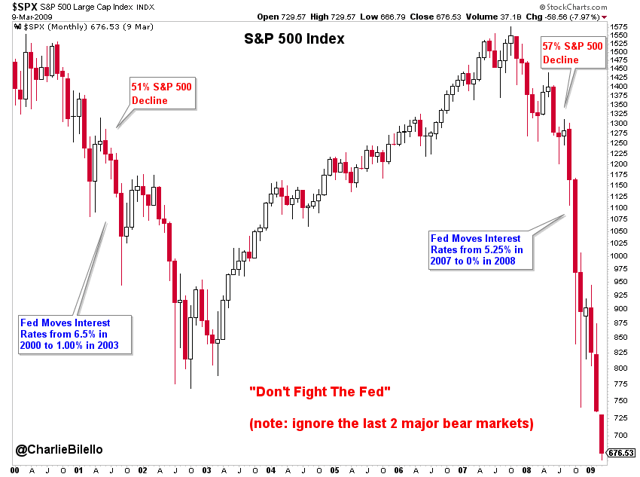

Here are two times that saw the Fed changing course, i.e. shifting from tightening to easing, just as we’re seeing over recent months:

1) January 3rd, 2001: The Fed cut rates by 50 bps with the S&P 500 closing the day at 1,347.

What happened then after?

The S&P 500 declined 43% until reaching its October 2002 low while the Fed kept cutting all the way down.

2) June 30th, 2004: The Fed hike rates by 25 bps with the S&P 500 closing the day at 1,140.

What happened then after?

The S&P 500 rose 33% until reaching its September 2007 high while the Fed kept hiking (16 more times) all the way up.

3) September 18th, 2007: The Fed cut rates by 50 bps with the S&P 500 closing the day at 1,519.

What happened then after?

The S&P 500 declined 56% until reaching its March 2009 low while the Fed kept cutting all the way down.

4) December 16th, 2015: The Fed hike rates by 25 bps with the S&P 500 closing the day at 2,073.

What happened then after?

The S&P 500 rose 45% until reaching its July 2019 high (3,027.98 on July 26th) and rate cut (July 31st) while the Fed kept hiking (8 more times) all the way up.

Possible conclusions:

1) Adages, even those quoted by Lloyd Blankfein, are (at best) good advice for life, certainly not valid investment strategies.

2) You don’t want to fight the Fed at most times. That, of course, unless a major bear market is heading our way.

3) In the endless battle between momentum (MTUM) to value (VLUE), as measured by the ratio between the iShares Russell 2000 Value ETF (IWN) to iShares Russell 2000 Growth ETF (IWO), we might be witnessing an inflection point.

(Source: SeekingAlpha)